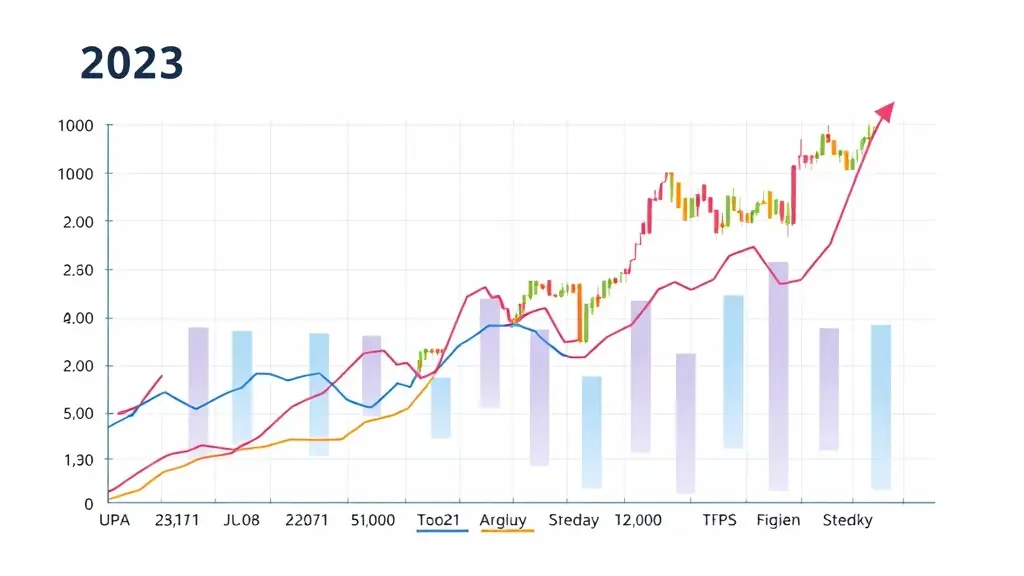

As we move into 2023, the stock market is poised for significant changes influenced by various economic factors. Analysts predict that interest rates, inflation, and geopolitical events will play crucial roles in shaping market trends. For traders, staying informed about these developments is essential for making strategic investment decisions. This article highlights key trends to watch in the stock market this year.

One major trend to consider is the impact of rising interest rates on stock valuations. Higher rates can lead to increased borrowing costs for companies, potentially affecting their profitability. Additionally, sectors such as technology and consumer discretionary may experience volatility as investors reassess their risk appetite. Understanding these dynamics can help traders position their portfolios effectively.

Another trend to monitor is the growing emphasis on sustainable investing. Environmental, social, and governance (ESG) factors are becoming increasingly important for investors, influencing stock performance. Companies that prioritize sustainability may attract more investment, while those lagging behind could face challenges. At TradeSphere, we provide in-depth market analysis to help you navigate these trends and make informed trading decisions.