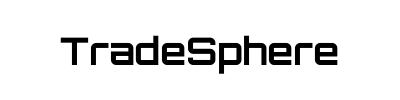

Cryptocurrency has taken the financial world by storm, with Bitcoin leading the charge as the first decentralized digital currency. Since its inception, the market has expanded to include thousands of cryptocurrencies, each with unique features and use cases. For traders, understanding the volatility and market dynamics of cryptocurrencies is essential for making informed decisions. This article delves into the factors driving the rise of cryptocurrency and what traders should consider.

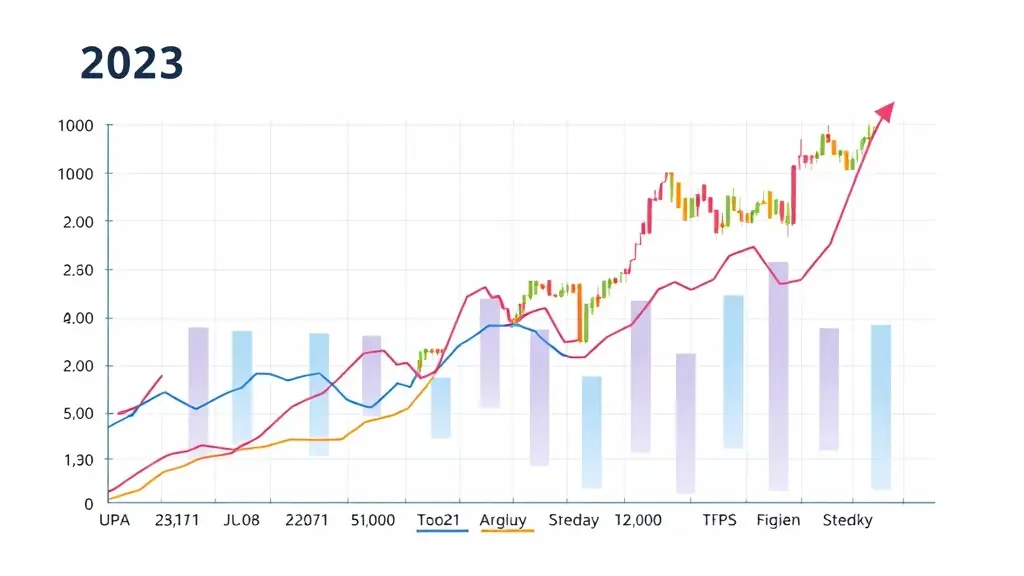

One of the key aspects of cryptocurrency trading is its inherent volatility, which can present both opportunities and risks. Prices can fluctuate dramatically within short periods, influenced by market sentiment, regulatory news, and technological advancements. Traders must stay informed about these factors and develop strategies to navigate the unpredictable nature of the crypto market. Utilizing tools like real-time market analysis can help traders make timely decisions.

Moreover, the importance of security cannot be overstated in the cryptocurrency space. With the rise of digital assets, the risk of hacking and fraud has also increased. Traders should prioritize using secure wallets and reputable exchanges to protect their investments. At TradeSphere, we provide resources and guidance to help you trade cryptocurrencies safely and effectively.